I want you to take a look at these pictures.

They were taken on August 4 by my wife as we flew out of the Sarasota-Bradenton airport (SRQ).

What you’re looking at is the northern end of Longboat Key, Florida. Longboat Key is a part of a string of beaches that comprises Anna Maria Island, Holmes Beach, Coquina Beach, and Bradenton Beach.

In the last six years, the price of new home construction on LBK has risen 250%, making real estate on the 11-mile island some of the hottest in the nation.

I know it’s true.

Let me explain. Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “How to Make Your Fortune in Stocks”The Best Free Investment You’ll Ever Make

It contains full details on why dividends are an amazing tool for growing your wealth.

Since buying our Longboat Key home in the summer of 2016, construction on the island has never ended. Even during the height of the pandemic, construction vehicles were more common to see than fishing or cruising boats.

I live on the northern end of the island, close to the locals' favorite party hangout, Beer Can Beach. I can walk to it — that’s how close I am. But I rarely drink beer there.😉

My house is on a canal street with 20 other houses. It’s quiet and idyllic, just the way my wife and I dream our retirement will eventually be.

My street ends in a cul-de-sac that overlooks Sarasota Bay. In 2021, the property at the end at the cul-de-sac was listed for sale. The property was as beautiful as it was historic to the island.

Here’s what it looked like in 2021:

Rumor has it that the property was sold the same year for $7.5 million to a very popular country music star. The views of the bay alone were easily worth half that much, the house the other half… Or so we thought.

The new owner promptly sent in the demolition crew and tore it all down, including the home you see in the picture. And activity on that property hasn’t stopped since. For nearly two years it’s been like a beehive or ant farm, with workers coming in and coming out nonstop.

But we are lucky, I guess.

A few miles south of us is the site of the former Colony Beach and Tennis Resort, which many argue made Longboat Key one of the top destinations in America for tennis players.

According to the story…

In 1967, Dr. Murray “Murf” Klauber, an orthodontist from Buffalo, New York, was preparing to fly out to St. Louis to speak at an orthodontics conference. His first wife had been staying at Longboat Key with friends at the time and urged him to make a detour there. Arriving at the Colony resort, he quickly fell in love with the beautiful yet largely undeveloped island.

Within a year of his visit, Klauber and his family moved to Longboat Key. By 1969, he and a business partner had purchased the Colony resort for $3.5 million, turning it into the first “tennis-centric resort” in America.

Nick Bollettieri, the legendary tennis coach, started his tennis academy there when he was an instructor at the Colony. As a way to fill up empty rooms between Thanksgiving and Christmas, the Colony hosted the annual Bud Collins Hackers Classic tennis tournament starting in 1986. Up to 2004, the Colony was recognized as the No. 1 tennis resort in the country by Tennis magazine for eight consecutive years.

But it wasn’t all tennis.

I have friends who are longtime LBK residents who still recall fond memories of drinking at the Colony’s Monkey Room bar, listening to Eddie Tobin play Billy Joel and Neil Diamond on the piano.

But it wouldn’t last. Constant infighting and litigation among association board members and owners over the Colony’s renovation expenses finally sent the resort into bankruptcy and foreclosure in 2009.

The resort would remain deserted for 13 years. It became a home to coyotes, foxes, and everything else native to Florida… Until now!

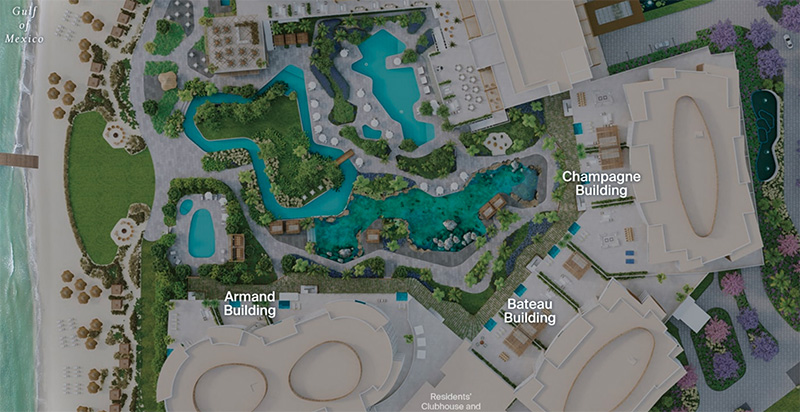

New owners sent in the bulldozers and wrecking ball in late 2021 to make room for the Residences at The St. Regis Longboat Key, a new luxury resort.

It's being built by Unicorp National Developments. This rendering should give you an idea of the grand scale of this resort:

Again, construction on our 11-mile long island has been insane, so much so that workers are getting bussed into the island and onto the job sites. And recently released numbers support it.

According to a August 16, 2023, article of our local news outlet, the Longboat Observer:

Demand for luxury living on Longboat Key has been on an upward trend the last six years, according to new construction permit data.

In 2017, the Planning, Zoning, and Building Department issued five new residential construction permits. A couple years later, in 2022, that number jumped to 32. To date in 2023, there have been 17 new construction permits issued.

The median value of new residential construction has also steadily increased, from $475,000 in 2017 to $1,679,420 in 2023 to date.

That’s about a 250% increase in just six years. And there are no signs it’ll stop anytime soon. That’s good for the value of the home I purchased in 2016. But bad for getting a reservation at some of our favorite restaurants on the island.

First-world problems, right?

Yes. But I’m not here to tell you about the two-hour wait times I’ll have to endure at Dry Dock Waterfront Grill this January. I’m here to tell you more about real estate… and specifically real estate investment trusts, because I think REITs — one of my favorite places to invest money — are about to go on a run.

Take a look at this chart:

Funds haven’t been this underweight REITs since 2008, at the height of the financial crisis. After the crisis, REITs went on to a 7–8-year bull market.

This is a chart of Realty Income Corp. (NYSE: O), one of the most popular REITs on the market for the last few decades. You’ll notice the run it had after the financial crisis of 2008–2009.

And I’m seeing signs again that REITs are putting in a technical pattern to run a lot higher in the coming months and years.

Innovative Industrial Properties (NYSE: IIPR) recently made a YTD high on August 11, 2023, at $82.78 a share.

Innovative Industrial Properties is probably my favorite REIT right now.

I recently dipped my toe back into IIPR on June 5, 2023, at $67.74 a share, representing a gain of 22% in just two months. Plus, I’m getting a sweet 10.5% dividend on top of the gain.

I think it’s going back to well over $100 a share. I remain a buyer.

We will continue to get to the good grass first,

Brian Hicks Brian is a founding member and President of Angel Publishing. He writes about general investment strategies for Wealth Daily and Energy and Capital. Brian is the managing editor and investment director of R.I.C.H Report (Retired Independent Carefree Healthy) and New World Assets. For more on Brian, take a look at his editor’s page.